Products & Services

BANKS:

With the Swift India channel, banks can consolidate all their communications with external parties onto a highly reliable, scalable, and secure messaging platform, thereby reducing complexity and costs.

MARKET INFRASTRUCTURES:

Swift is already used by over 100+ financial institutions in India. By using our channel for communicating with payments systems and other banking market infrastructures, you’re able to focus on their core functionality and rollout new and improved services faster.

CORPORATES:

Gain better visibility of your cash, enable faster and more streamlined payments, reduce financial risks, and enhance treasury/FX confirmations and trade finance operations for corporates with APIs for cost-effective connectivity with your banks.

Whether your business is payments, cash management, treasury, or trade finance. Whether you are a small local brokerage or a global multi-service bank; Swift India enables you to automate, standardise and consolidate your channels of communications with regulators, counterparties, market infrastructures and customers to conduct your business in a reliable, secure and efficient manner

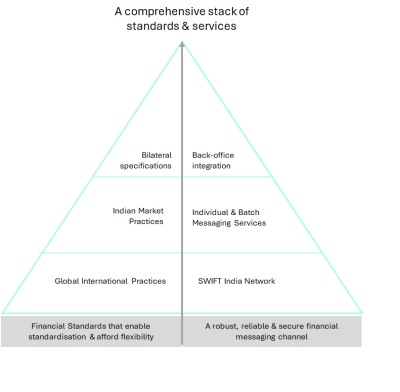

Comprehensive solutions

Swift India provides a comprehensive solution comprising of messaging standards, infrastructure and security framework all backed by Swift SC’s world-class 24/7 premium support services.

Reuse Your Swift Connectivity

With Swift India, you can easily leverage your existing Swift connectivity to communicate with all your domestic counterparties.

Benefits of Swift India

- Efficient Communication:

Exchange various types of instructions, whether they are individual or batched. - Large File Transfers:

Transfer large files containing structured and unstructured information, such as thousands of low-value payment instructions or images of supporting documents. - Guaranteed Delivery & Confirmation:

Ensure the delivery of your instructions and receive a confirmation of delivery. - Validation & Error Prevention:

Validate the structure and integrity of instructions before delivery, eliminating costly errors. - Authenticity Assurance:

Confirm the authenticity and integrity of instructions in the event of a dispute.

All this is supported across a variety of market segments, instruments, and asset classes, including payments, cash management, trade finance, treasury and security.

Banks | Swift India

Simplifying Communication Across the Indian Financial Community

To meet today’s expectations, banks must invest considerable time and money to communicate effectively with their community across a variety of languages and channels. The Swift India messaging platform serves as the foundation bringing the Indian financial community together.

Banking Market Infrastructures | Swift India

By concentrating banking functions and sharing of infrastructure and investments, banking market infrastructures function as central counterparties to banks, and add tremendous value to the banking sector.

- High and low value payments clearing & settlement systems

- card switching systems

- trade repositories

These are all examples of banking market infrastructures in India that facilitate the safe and secure execution of inter-bank transactions.

Swift India a trusted third party for market infrastructures

As they play a critical role in the financial system, banking market infrastructures have come under increasing scrutiny from local and global regulators. To ensure markets operate safely and securely, regulatory bodies have come together to define how such market infrastructures should operate in fulfilling this critical role.

The CPSS-IOSCO Principles for Financial Market Infrastructures is one such key framework adopted by the Reserve Bank of India. This framework defines best practices in how banking market infrastructures should operate, and how Critical Service Providers to market infrastructures should operate.

Swift India is a natural trusted third party to market infrastructures, that fully complies with these best practices and expectations of Critical Service Providers, enabling market infrastructures to meet their own stringent obligations and expectations from regulators.

Enables focus on key market infrastructure functions

The primary goal of banking market infrastructures is to mitigate bilateral risks by centralising functions and establishing a common framework of operating guidelines. Banks no longer have to manage hundreds of bilateral relationships and operating protocols but can instead rely on a trusted and independent central counterparty.

Swift India complements the services of banking market infrastructures by providing a common and standardised financial messaging platform for the banking industry. Market infrastructures now can focus on their core functionality, rather than managing the network and transmission of information.

A common Swift India channel also allows market infrastructures to reduce the operational complexity and cost of communications for their bank customers.

Corporates | Swift India

Large and medium-sized corporations are a vibrant and fast-growing segment of the business sector in India. They add tremendous value to the country through their products and services, employee large portions of the citizens of the country and are a strong driver of growth and stability.

Corporates face much competition and challenges in today’s global marketplace, and therefore must operate efficiently, with confidence and predictability. Corporate treasurers are at the forefront in meeting this challenge.

As a consequence, corporate treasurers must:

- Have visibility of their cash across local and foreign banking relationships

- Achieve efficiency in managing their working capital

- Ensure compliance to local regulations, impacting global operations (such as SOX and SEPA)

- Operate their business units as not just cost centres but enablers of their company’s strategy, affording flexibility and agility in business decision making and operations

Swift India offers a single window to corporate treasurers as they communicate across their banking relationships. This enables standardisation, rationalisation, automation, and improved security.