Vision

Building best in class secure & standard messaging system for digitizing financial ecosystem in India.

In 1973 SWIFT SCRL was founded on the principle that collaboration and cooperation can solve big, common problems. Four decades on, the banking co-operative operates a financial messaging platform that brings together 10,500 financial institutions and corporations across 215 countries. Built on this are a variety of financial applications, business intelligence, reference data and most recently compliance services. The network and its members exchange more than 22 million payments, securities, trade finance and treasury messages daily in a highly reliable, secure and resilient manner.

SWIFT India Domestic Services Pvt Ltd (“SWIFT India” or “the Company”), founded on similar principles, is a financial messaging services provider formed by SWIFT SCRL and Indian banks, for the domestic Indian financial community and by the community.

Through shared resources and capital, SWIFT India functions with the objective of enabling harmonised exchange of structured financial information between domestic participants in the domestic Indian community, thereby

a) reducing costs and risks,

b) expanding the reach of automated, standardised and secure exchange of information across the industry,

c) enabling new instruments, opportunities and markets for the industry.

SWIFT India’s priorities are defined and guided by the Indian financial industry, our customers and shareholders. In fulfilling our mission, we adopt a consultative approach, ensuring key stakeholder views are systematically sought and reflected in our actions. SWIFT India Solution Working Groups are an example by which the Company consults with you- our customers, to shape market practices, standards and design of the SWIFT India channel to best meet your needs.

Furthermore, we strive to be transparent, dependable and accountable and take responsibility and ownership to deliver on our commitments to you. We strive to be disciplined in our planning and delivery so that you in turn can plan and execute with confidence.

From disparate channels and standards

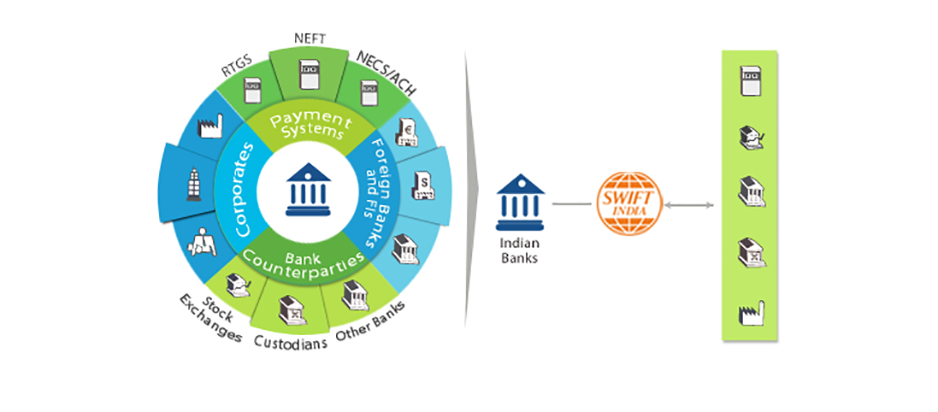

The Indian financial community is comprised of a variety of actors and agents, consisting of regulators, government agencies, banks, non-banking financial institutions, payments and securities market infrastructures, exchanges, repositories, corporate and retail customers, and their respective service providers.

To ensure timely execution of safe and secure transactions in this ecosystem, SWIFT India provides a highly reliable, secure and efficient financial messaging platform for the domestic market. This domestic messaging platform enables the structured exchange of information with the following key features:

- Message types:

- Real-time and bulk messages

- File transfer of structured and unstructured information

- Security:

- Role-based access control

- Maker-checker controls

- 3 layers of asymmetric encryption to ensure integrity, authenticity and confidentiality

- Hardware security modules

- Support for local Controller of Certifiying Authorities (CCA) licensed public key infrastructure (PKI)

- International and domestic standards:

- Support for international ISO 15022 (MT) and ISO 20022 (MX) message formats, including domestic to international message transformation

- Support for local market practices and flows

- Support for local addressing schemes such as the Indian Financial System Codes (IFSC)

- Value added message features:

- Guaranteed delivery

- Delivery confirmation and non-delivery warning

- Broadcast messages

- Syntax and rule-book message validation

- Non-repudiation proof of messsage transmission in case of dispute

- Message retrieval for 124 days in case of messages lost or corrupted by either sender or receiver

- Store-and-forward for when counterparties are not online

- Back-office integration for straight-through-processing

- Message transformation

- Multiple protocols (incluing SOAP, MQ, file transfer, etc)

- Custom workflows

- Premium support

- Standard 24/7 online and phone support

- Native support by back-office certified partners and services providers across Core Banking System, Treasury System, Cash Management Systems, Retail and Corporate Banking Systems. Payments Middleware and Enterprise Resource Planning Systems.

- Other premium support features such as onsite support, pro-active network monitoring and health checks, coordinated business continuity exercises, and others. Visit Support & Training for more information.

To find out more of SWIFT India services refer to Products and Services or Contact Us.

To order SWIFT India services refer to Ordering.